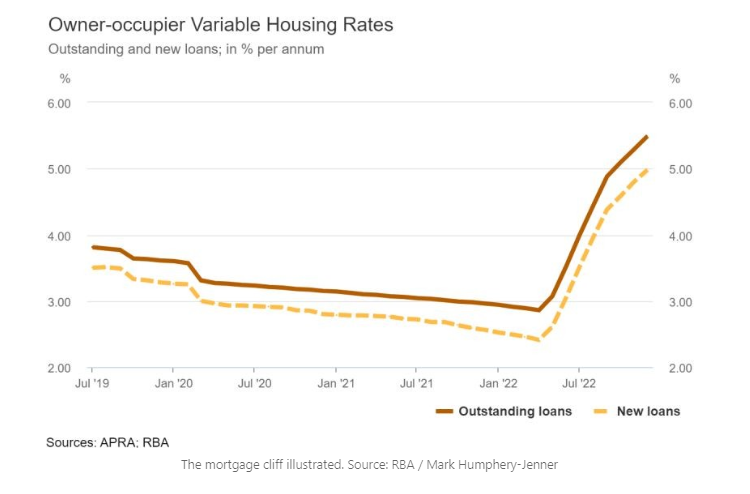

Remember when you could get two-year fixed term mortgages at 1.79%? If the same homebuyers were to refinance today, they would be looking at variable rates of around 5.75%.

That, in a nutshell, explains a mortgage cliff. As UNSW Business School‘s Mark Humphery-Jenner, PhD explains on LinkedIn, this cliff is coming — $350 billion worth of mortgages will come off fixed rates in 2023.

That’s 800,000 loans switching from the ultra-low fixed rates to very high variable rates.

So should you be worried? Not according to Humphery-Jenner who explains why banks will try to cushion the blow as much as possible.

He writes: “Banks hate fire sales. They often recover limited amounts, they are terrible PR, and they risk depressing the market and harming the rest of the loan book. Banks much prefer restructuring loans than forcing people to sell.”

Other factors that will prop up the market include:

- Homeowners who are not struggling will simply hold onto their property, reducing supply

- Some buyers will scoop up ‘bargains’, boosting demand

- Prospect of rate cuts is on the horizon for the next 12 months

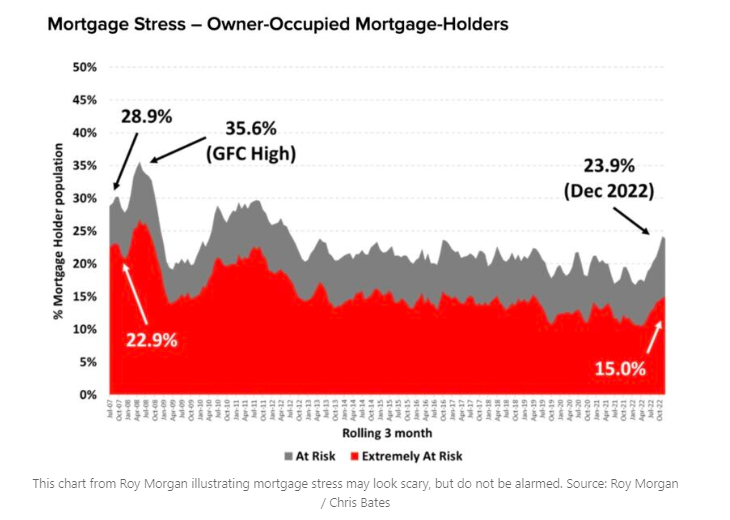

But the mortgage stress is real. According to this Roy Morgan poll, one in four mortgage holders are experiencing mortgage stress, which means they’re spending between 25% and 45% of after-tax income on mortgage.

But Wealthful. founder Chris Bates writes the impact of this will be limited to highly leveraged buyers in certain pockets only.

Why? As a mortgage broker he has seen time and time again banks going to extreme lengths to support homeowners.

He writes on LinkedIn: “The banks will do what they need to do. The truth is that even if there is mortgage stress, the banks, similarly to payment holidays in COVID, will be able to go to lengths that surprise us all to keep property owners in their homes. APRA will allow them to do it.

“Both CBA and Westpac CEOs came out last week to confirm this. They will extend loan terms, create payment holidays, allow interest only, cut rates and do whatever it takes to buy the borrower time.”

When it comes to preparing for the fall, financial educator Lacey Filipich is pragmatic. “We’re not going to change the RBA’s approach today … Make your plan now and put it somewhere safe so you can pull it out if/when you need it.”

Fintech specialist Luke Raven says to cushion the blow, use banking products to your advantage.

He writes: “Just like applying the brakes in a car, friction can be great in the right circumstances. You can use technology to help! Some banks offer ‘locked’ accounts or ‘vaults’ which can help prevent impulse-buys and curb your excess spending.”

Source: LinkedIn

Industry Insider Property

Level 3, 489 Toorak Road, Toorak 3142

+61 8374 7652

+61 402 346 810

industryinsider.com.au