Stamp duty or land transfer duty – as it’s sometimes called in Victoria – can be an unpleasant surprise for those embarking on the home owner journey. Stamp duty in Victoria is a large source of taxable revenue for the state government, consistently proving to be a thorn in the side of home buyers.

For many, it isn’t something that’s common knowledge. This guide will hopefully clear the air and help you understand stamp duty in Victoria.

What is stamp duty?

Stamp duty is a form of tax that applies to a number of transactions. These include:

- motor vehicle registration and transfer

- insurance policies

- leases and mortgages

- hire purchase agreements

- transfers of property (such as businesses, real estate or certain shares).

So if you’re in the market for any of these, stamp duty may apply to you.

This tax is levied by state or territory governments on certain purchases and can be affected by:

- how much you paid for the property

- current value on the market

- where the property is located

- whether it’s a home or investment property.

Meaning, the more expensive the property, the higher the stamp duty.

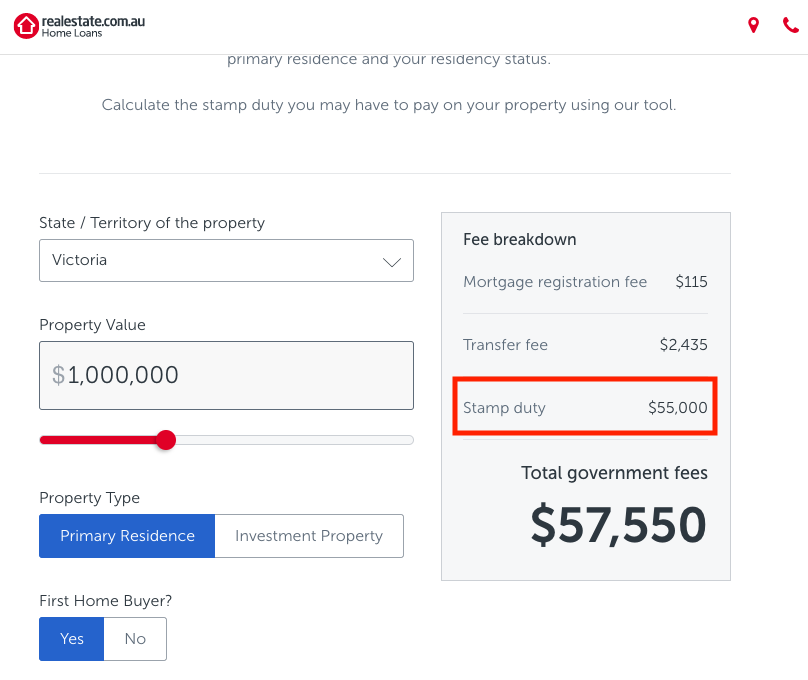

For example, for a $1m property the stamp duty is $55,000 – as indicated in the image below.

Use this stamp duty calculator to see how much you might have to pay, making sure that you select the right state to accurately calculate your stamp duty.

Stamp duty exceptions and the FHOG

In some circumstances, you may be exempt from paying stamp duty or get a concession to help cover the cost. These circumstances include:

Death or divorce exemptions

State governments offer stamp duty exemptions when property changes hands after a death or divorce, or is transferred between family members.

First home buyer exemption

Most state governments also offer first home buyers a complete exemption or a large concession.

In July 2017, the Victorian Government introduced concessions around stamp duty for first home buyers, offering a full exemption when they purchase a new or established home worth up to $600,000. This is on the condition that they live in the property for at least 12 months. For homes valued at $600,000 to $750,000 you can attain a partial exemption.

First Home Owner Grant

Although not directly related to stamp duty, another incentive for first home buyers is the First Home Owner Grant (FHOG). In Victoria, first home buyers can receive up to $20,000 (for those buying a home in regional Victoria), or $10,000 (if in a metropolitan area). The home must be less than five years old to be eligible for the FHOG.

Find out more about Victorian exemptions and concessions.

Want to know more?

Buying a home in 2019 can be a difficult process, with stamp duty adding another cost in your pursuit for a new home.

Get in touch with the expert Industry Insider team for help in buying a home. Stamp duty can be a frustrating part of an exciting process, and it’s one you can leave our team to handle. We prioritise you, so you can get your priorities right. Don’t hesitate to speak with one of our Property Buyer Agents on +61 8374 7652 or book a Zoom call here

https://calendly.com/propertychat/discussion-with-industry-insider

Industry Insider Property

Level 3, 489 Toorak Road, Toorak 3142

+61 8374 7652

+61 402 346 810

industryinsider.com.au